How to benefit from lower rate?

How to Mitigate and exempt the capital gain proceeds in case of NRI?

When it comes to selling a home they may own in India, NRIs frequently make mistakes. To guarantee tax compliance, the government uses TDS to collect taxes at the time of property transfer. Before engaging in such transactions, Non-Resident Indians (NRIs) selling property in India need to be aware of the unique tax ramifications. In order to satisfy their tax duties and stay out of trouble with the law and penalties, NRIs must be aware of these rules and regulations.

What is the TDS when an NRI sells real estate in India?

TDS (Tax Deducted at Source) on the sale of property by Non-Resident Indians (NRIs) in India is a mechanism implemented by the Indian tax authorities to collect taxes at the time of property transfer. The buyer of the property is responsible for deducting TDS from the sale proceeds and depositing it with the income tax department within the time prescribed. After deducting the TDS the buyer is required to file deduction and payment details in Form 27Q.

How do NRIs in India be taxed on their income from selling real estate?

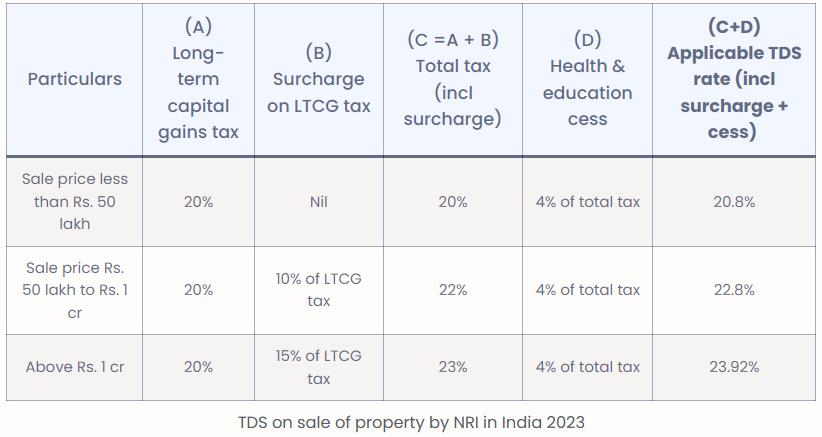

When non-resident Indians (NRIs) sell property in India, they are required to pay capital gains tax. When selling a property in India as an NRI, the buyer is required to deduct 20% of the sale price as Long Term Capital Gains Tax (TDS) for properties sold after two years. The short-term capital gains tax (TDS) rate is 30% for properties sold before two years have passed.

The original owner’s purchase date must be considered when handling inherited property in order to classify any capital gains as either long-term or short-term.

Rules for NRI Income Tax on TDS Deductible

You must be aware of certain income tax regulations pertaining to TDS (Tax Deducted at Source) as an NRI (Non-Resident Indian). In relation to TDS deductions for NRIs, the following points are crucial:

TDS relative to Income:

- Income earned by non-resident Indians (NRIs) in India, such as salary, rent, interest, capital gains, and so on, is subject to TDS.

- Depending on the type of income and the appropriate tax rates, the TDS rates may change.

- For the correct TDS deduction, NRIs must give the deductor their Permanent Account Number (PAN). NRI have to take PAN compulsory if there is any income in India on which tax is required to be paid.

TDS for Interest Earned

The payer withholds 30% of interest income generated by non-resident individuals (NRIs) on savings accounts, fixed deposits, or any other interest-bearing instrument, in addition to any relevant surcharge and education cess.

Let us assume, however, that the nonresident investor (NRI) is eligible for any tax exemptions or reduced rates under the Double Taxation Avoidance Agreement (DTAA) between India and their home country. Then, in order to benefit from the reduced TDS rate, individuals have to provide requisite documents validating the deduction of tax at lower rate.

TDS for Capital Acquired:

- When selling real estate, stocks, or any other type of capital asset in India, NRIs are liable for capital gains tax (TDS).

- The kind of asset and length of holding are two factors that can affect the TDS rates for capital gains.

By filing their income tax returns, NRIs can request a refund for any excess tax that was deducted.

TDS Exemptions:

- By getting a Certificate of Lower Deduction or No Deduction from a chartered accountant, non-resident individuals (NRIs) can petition for lower TDS rates or claim exemptions.

- This certificate lowers the TDS liability for non-resident Indians and is necessary for certain transactions.

In India, a buyer who purchases a property from an NRI is required to deduct tax at the following rates depending upon the sale proceeds from the transaction

A TDS as per Income tax slab is required to collected if a property is sold before the two-year period.

When selling a home, who is required to pay TDS?

The buyer of the property is in charge of taking the Tax Deducted at Source (TDS) amount out of the sale proceeds and giving it to the Non-Resident Indian (NRI) seller. The buyer must submit Form 27Q with the deduction and payment information after deducting the TDS.

The buyer must apply for and receive a Tax Deduction Account Number (TAN) in their name in order to expedite this process. Each person participating in a combined purchase of a property with another person, whether through joint financing or personal savings, needs to obtain a TAN.

After submitting the TDS amount, the buyer has to file the TDS return in the subsequent quarter in order to meet their regulatory duties. Form 16A is made available to the buyer upon successful TDS return filing, and it is thereafter given to the NRI seller.

Both the buyer and the NRI seller guarantee tax compliance by following these rules, which promotes an open and lawful real estate transaction process.

How can an NRI sell a home and avoid paying capital gains taxes?

According to the income tax regulations for non-residents, an NRI may be able to save taxes while selling a property under Sections 54, 54EC, and 54F.

Section 54 Exemption

If the proceeds of the sale of an NRI’s residential property are reinvested in another residential property, this provision exempts the NRI from long-term capital gains tax. Important things to remember are:

Eligibility: Both residents and NRIs are eligible for the exemption.

Application: Long-term capital gains on the sale of a residential property held for a minimum of 24 months are free from taxation.

Reinvestment: Within the allotted time limits, the taxpayer must use the sale profits to buy another residential property.

Conditions:

There can only be one residential property eligible for the exemption.

– The new property must be built within three years after the sale date, or it must be purchased within a year before, two years after, or both.This new home property must be located in India. Properties that are purchased or built outside of India will not be eligible for the section 54 exemption. Exemption will be revoked if the individual sell the new property within three years of buying it.

Amount of Exemption:

The cost of the new residential property or the long-term capital gains, whichever is lesser, is the amount of exemption.

Section 54EC Exemption

If the proceeds are placed in certain bonds, this clause permits an exemption from long-term capital gains tax. To be aware of in this case are

Eligibility: Both residents and NRIs are eligible for the exemption.

Application: Long-term capital gains on the sale of any asset, including real estate and non-real estate, are exempt from taxation.

Bond Investment: Within six months of the sale date, the taxpayer may use the capital gains to purchase designated bonds from the Rural Electrification Corporation (REC) or the National Highways Authority of India (NHAI).

Exemption Amount: Up to a maximum of INR 50 lakhs in a fiscal year, the exemption amount is restricted to investments made in the designated bonds.

Lock-in duration: The bonds mentioned above have a five-year lock-in duration.

Section 54F exemption

If the profits of the sale of any asset other than a residential property are invested in a residential property, Section 54F exempts the seller from long-term capital gains tax. These are important things to remember:

Eligibility: Individuals and Hindu Undivided Families (HUFs), including NRIs, are eligible for the exemption under Section 54F.

Application: With the exception of residential properties, the exemption covers long-term capital gains on the sale of any asset, including land, buildings, and other capital assets.

Reinvestment: The taxpayer must use the net sale profits to build or buy a residential property in order to qualify for the exemption.

Investment timelines: a. Purchase: The new home must be acquired either one year prior to or two years following the date of the old asset’s sale. b. Construction: The taxpayer has three years from the date of the sale to finish any new residential property that they decide to build. The location of this new home must be in India.

Conditions: a. Ownership: On the date of the original asset’s sale, the taxpayer may not possess more than one residential home, other than the new property. a. Lock-in Period: From the date of acquisition, the new residential property must be held for a minimum of three years. The exemption claimed under Section 54F would be removed and the capital gains will be taxed if it is transferred within three years.

Exemption Amount: The percentage of the net sale proceeds that is allocated to the new residential property as an investment goes toward calculating the exemption amount. If all of the net sale proceeds are invested, the long-term capital gains are tax-free. Should you invest merely a portion, the exemption will be determined in accordance with that amount.

Repercussions for failing to pay TDS

When the buyer neglects to deduct TDS for whatever reason or does not follow the prescribed TDS (Tax Deducted at Source) rates that apply to Non-Resident Indians (NRIs), they run the risk of facing serious legal repercussions. It is critical that purchasers understand that they have a legal obligation to deduct and submit TDS at the rates that apply to NRI sellers, or at the rates listed in the Income Tax Department’s NIL/lower deduction certificate.

Buyers who fail to deduct TDS at the prescribed rates would be subject to penalties equal to the amount of TDS that was not deducted. Interest is also charged on the amount that is past due. The seller’s ability to repatriate the sale money to their foreign bank account or NRE (Non-Resident External) account is also hampered by the failure to deduct TDS. Furthermore, the seller might be prosecuted for falsely reporting their tax resident status if the Income Tax Department examines the transaction and finds that TDS was not properly deducted.

Therefore, in order to prevent legal ramifications and guarantee trouble-free transactions with NRI sellers, purchasers must strictly adhere to the prescribed TDS requirements. This preserves the integrity of the tax system in addition to protecting the interests of all parties concerned.

NRIs can reduce tax obligations, make well-informed judgments, and steer clear of any possible legal or financial entanglements while selling property in India by knowledgable and sound professionals at A K Y V AND CO LLP.